Could Egypt cut into Qatar’s gas market?

CAIRO - Qatar has been chosen to host the 2021 summit of the Gas Exporting Countries Forum, highlighting its strong position in the global natural gas market but reports and estimates reveal Doha could face obstacles in meeting its energy objectives over the next decade.

While Qatar was celebrating its selection as Gas Exporting Countries Forum host, Egyptian state-affiliated media picked up on a report by the Qatari anti-regime organisation Mubasher Qatar questioning Doha’s ability to expand its liquid natural gas (LNG) production and exports as planned.

The report suggests that a potential glut in the gas market because of increased global production could pose problems for Qatar, which announced plans to increase annual LNG production 64% — from 77 million to 126 million tonnes per year — by 2027.

Statista, a German online portal for statistics, said the average consumption of liquefied or non-liquefied natural gas stood at 3.849 trillion cubic metres in 2018, just less than production, which reached 3.868 trillion cubic metres.

The most optimistic forecasts from McKinsey and Company, the largest management and economic consulting firm in the United States, stated the volume of demand for liquefied gas up to 2035 would increase cumulatively 3.6% yearly.

That means it would increase by 37.5% of current production and demand by 2028, rendering a 64% increase in Qatari production far above global market capacity.

Sayed el-Morsy, a retired deputy director of cost control at Apache Petroleum, said the expected production glut would be because of the “expansion of Australia, Russia, China and Iran along with some smaller markets in East Asia and the Middle East, such as Greece, Cyprus, Egypt, Turkey and Israel, in the production of conventional natural gas and United States’ expansion of shale gas production.”

He noted that “in the case of a glut of increased production versus consumption, there is an opportunity for producing countries that are able to offer more competitive price advantages, payment terms, agreements and transportation means such as pipelining, which is more rapid and more competitive price-wise, as there will be no major shipping costs.”

“Egypt is a strong candidate,” Morsy added.

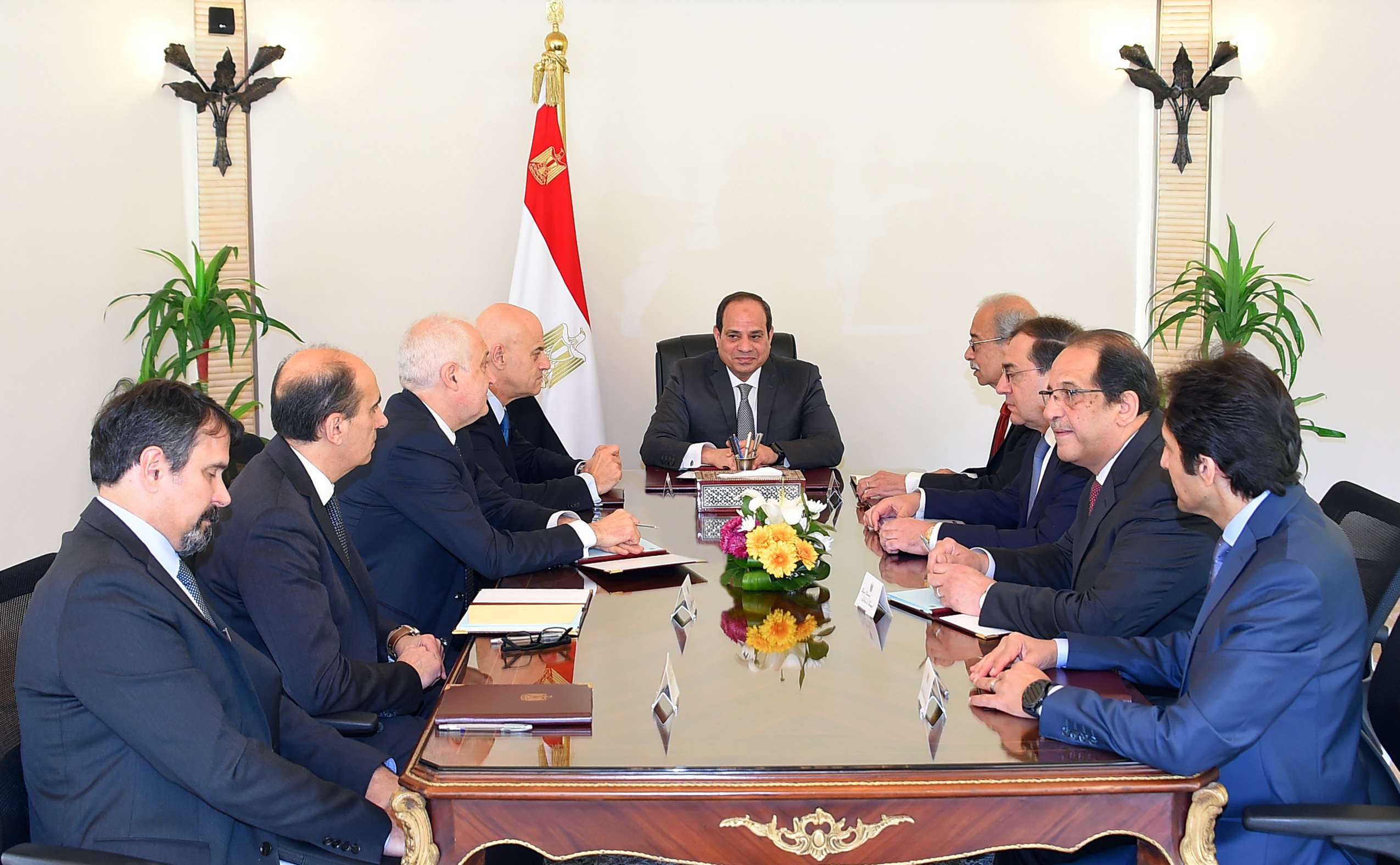

In July, Egyptian President Abdel Fattah al-Sisi ratified an agreement linking Egypt to Cyprus via a pipeline to export Egyptian gas to Cyprus and from there to Europe.

Qatar could also face trouble pipelining its gas due to a years-long regional rift with Saudi Arabia, the United Arab Emirates, Egypt and Bahrain.

In December 2016, Syrian President Bashar Assad told Italian media that Qatar and Iran were working on projects to export gas to Europe with pipelines passing through Syria and then into Turkey or the Mediterranean, Cyprus and Europe.

It seems the Qatari project will falter because it is impossible for its pipeline to go through Iraq and then Syria without entering Saudi territory or Bahraini territorial waters — controlled by two of the quartet countries boycotting Qatar since July 2017.

The Iranian project is expected to remain on hold until European and US sanctions against Tehran over its nuclear programme are cancelled.

The Arab boycott of Qatar likely exacerbated the erosion of Doha’s resources and its declining economic growth rate — 33% from the end of 2016 until the end of 2018 — further depriving Qatar of the resources it needs to increase its production of liquefied gas.

Already it has struggled to keep pace. In July 2017, Qatar announced a plan to gradually increase LNG production from 77 million to 100 million tonnes per year by 2024. However, Qatar’s production has not increased, despite resuming production from the North Field in 2017 after twelve years of inactivity.

Bloomberg News estimated the cost of increasing production to 100 million tonnes at $27.6 billion, suggesting the plan to raise production to 126 million tonnes per year in 2027 could cost around twice that amount.

Any prospects for reconciliation in the Gulf, likely predicated on Doha downgrading relations with Iran with which it shares the crucial North Field, would hamper Qatar’s ambitions to expand gas production, Qatari Energy Minister Saad al-Kaabi said in a press conference November 25.

While Egypt, which aims to produce 11.3 billion cubic feet per year in 2022, cannot compete with Qatar’s overall production, which stands at 17 billion cubic feet per day, it could become a bigger player if its gas is pipelined to Europe and Qatar continues to be entangled in its regional dispute.

This article was originally published in The Arab Weekly.