Egypt on cusp of economic shift with gas sufficiency

CAIRO - Egypt’s increase in natural gas production, which has allowed Cairo to balance national consumption, is an economic turning point that will have far-reaching effects, officials said.

“This is a development that will have an effect on all aspects of the economy,” said Hamdi Abdel Aziz, Ministry of Petroleum spokesman. “The rise in national production will create a financial surplus that will help us a lot as we work on the development of our country.”

Petroleum Minister Tarek al-Mulla announced on September 28 that Egypt had received its last imported shipment of liquefied natural gas. He said with local gas production steadily rising, Egypt would no longer import liquefied gas.

National gas production in September was 6.6 billion cubic feet per day, up from 6 billion cubic feet in July. This means gas extracted from domestic wells would meet national consumption for the first time in ten years.

Over the past decade, Egypt needed to import natural gas because of the failure to upgrade production wells and find new gas sources. Cairo was spending approximately $3 billion a year on gas imports.

Political unrest following the 2011 revolution in Egypt also had a major effect on the economy, production and the tourism sector, which meant Egypt’s energy sector faced even greater challenges.

A major change came in 2015 when the Italian Eni energy giant discovered a massive gas field off Egypt’s Mediterranean coast. The Zohr gas field — one of the largest gas fields in the region — went into production in December 2017 and is delivering 2 billion cubic feet of gas per day, with production expected to rise to 2.7 billion cubic feet per day by 2019.

Along with other production facilities, the Zohr gas field promises to alter Egypt’s economic reality.

In addition to cutting costs by no longer importing liquefied natural gas, Egypt will save money on butane gas imports. Egypt imports almost half of its annual butane gas consumption of 4.5 million tonnes, paying around $187 million a month.

The government subsidies butane gas for consumers, selling butane gas cylinders at one-third of market price. Many Egyptians use butane gas cylinders, particularly for cooking. The government allocated $5 billion for fuel subsidies in the 2018-19 budget.

Money saved in this regard will lower the budget deficit by $6 billion annually, economists said.

“This drop will mean that the government will have a better chance of significantly reducing the budget deficit in the future,” said Egyptian economist Fahkry al-Fiqqi. “This will reflect positively on the overall conditions of the economy and help us move ahead with economic and social development plans.”

The budget deficit is expected to reach $24 billion by July 2019, the end of the current fiscal year. That would be down almost $500 million from the budget deficit in the 2017-18 fiscal year.

The presence of enough gas for national consumption, economists said, would boost investor confidence and help industrial investors expand projects.

Hundreds of factories have closed since the 2011 revolution, either because of political and security unrest or because of the lack of fuel.

Many factories are reopening with hopes that cheaper fuel will help Egypt’s manufacturing and production industry.

“This will help us attract even more industrial investments,” Fiqqi said.

Egyptian leaders said they expect to send its gas to international markets in 2021, pinning sector expansion on a steady growth in production and potential additional discoveries.

Eni is working to determine the scale of a gas field off the Mediterranean coast of Sinai. Egypt has also collected seismic data about its Red Sea coast, amid expectations that the area, which stands opposite Saudi Arabia’s western Red Sea coast, contains huge oil and gas reserves.

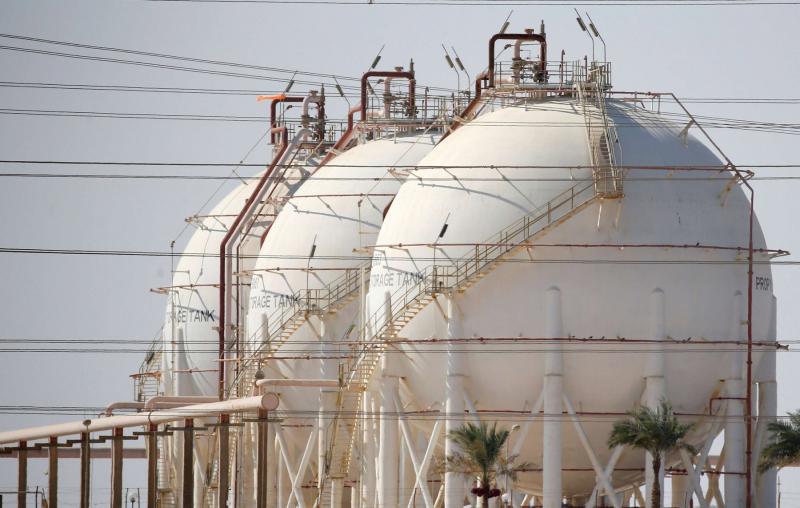

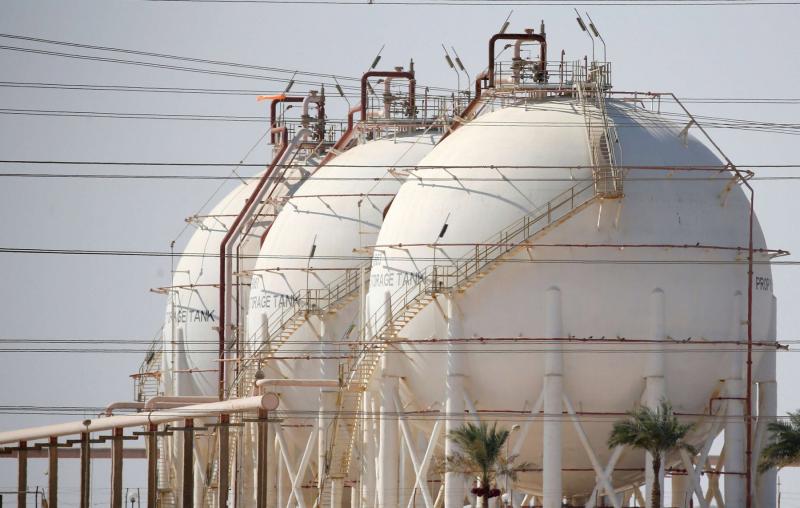

Egypt is also spending billions of dollars to upgrade and expand its gas liquefaction facilities.

All these developments, the government says, brings Egypt closer to becoming a regional energy hub.

“The realisation of this dream is increasingly becoming within national reach,” Abdel Aziz said. “Our production is on the rise; we are close to production centres and markets and also have the necessary liquefaction and refining facilities.”

Amr Emam is a Cairo-based journalist. He has contributed to the New York Times, San Francisco Chronicle and the UN news site IRIN.

This article was originally published in The Arab Weekly.